AI-First Without Fear: What Duolingo Reveals About Workforce Evolution

When Duolingo’s CEO Luis von Ahn announced an “AI-first” pivot, the backlash was immediate. Users and employees alike questioned whether automation meant elimination. Yet his clarification — that the company has never laid off full-time employees and does not plan to — reframes the story. The real shift isn’t about reduction. It’s about reallocation.

This moment captures one of the most persistent frictions in AI adoption: cultural resistance and fear of displacement. The same unease surfaces in trust companies and family offices. Leaders want the efficiency of AI but hesitate before its human cost. Employees fear redundancy, while clients fear depersonalization.

The lesson from Duolingo is subtle but profound: AI adoption succeeds only when it is framed as evolution, not replacement.

AI as a Liberator, Not a Threat

At Duolingo, engineers and designers are not being replaced by code. Instead, they are being freed from rote, low-value tasks. AI handles the grind. Humans reclaim the creative, strategic, and relational work that defines enduring value.

Trust companies face a similar horizon. Document review, compliance checks, reconciliations — these are vital but repetitive. AI can execute them at scale, with speed and accuracy that surpasses any manual process. Yet trustees remain essential. They interpret nuance. They cultivate trust. They hold the fiduciary duty that no algorithm can.

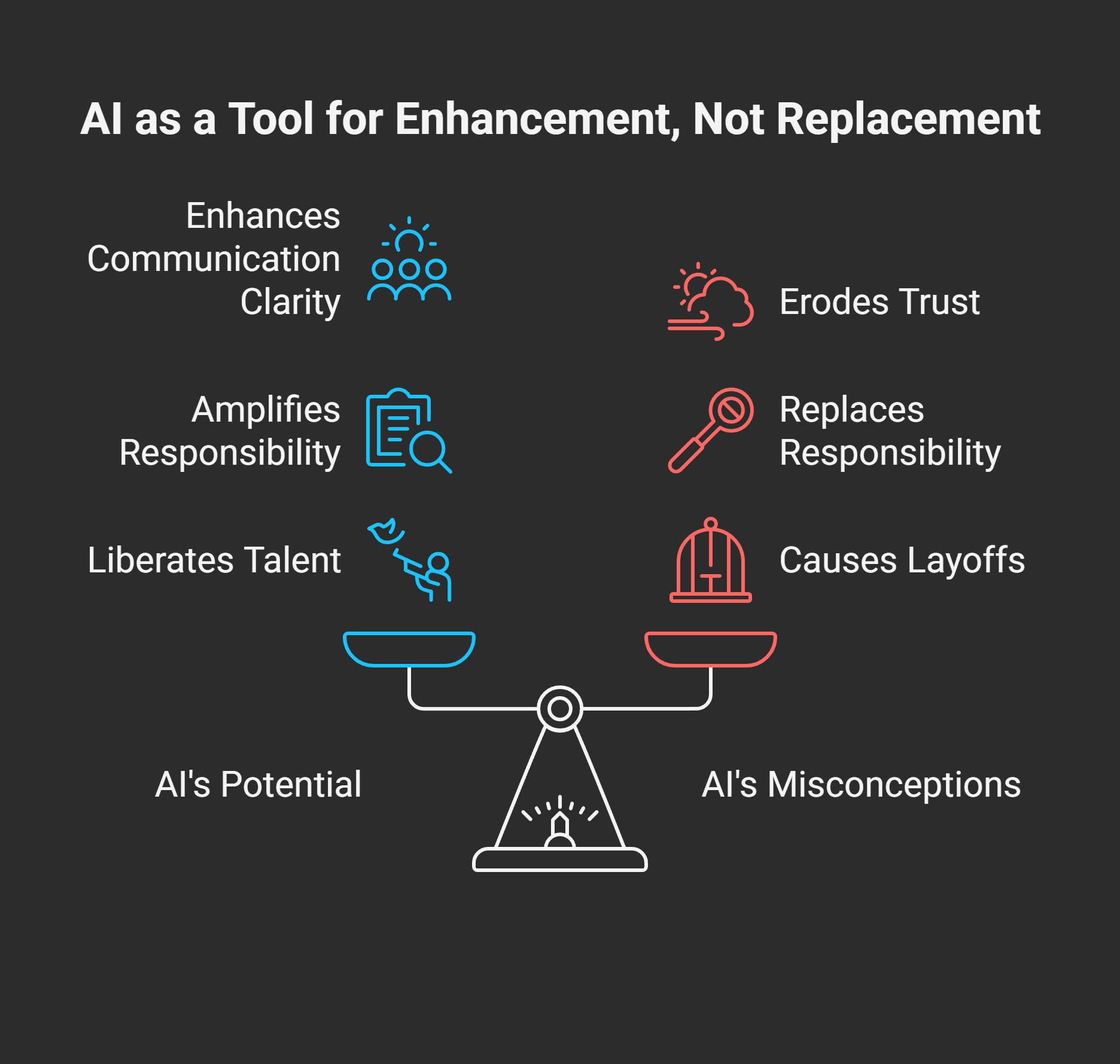

The cultural reframing is critical: AI doesn’t erase roles; it elevates them.

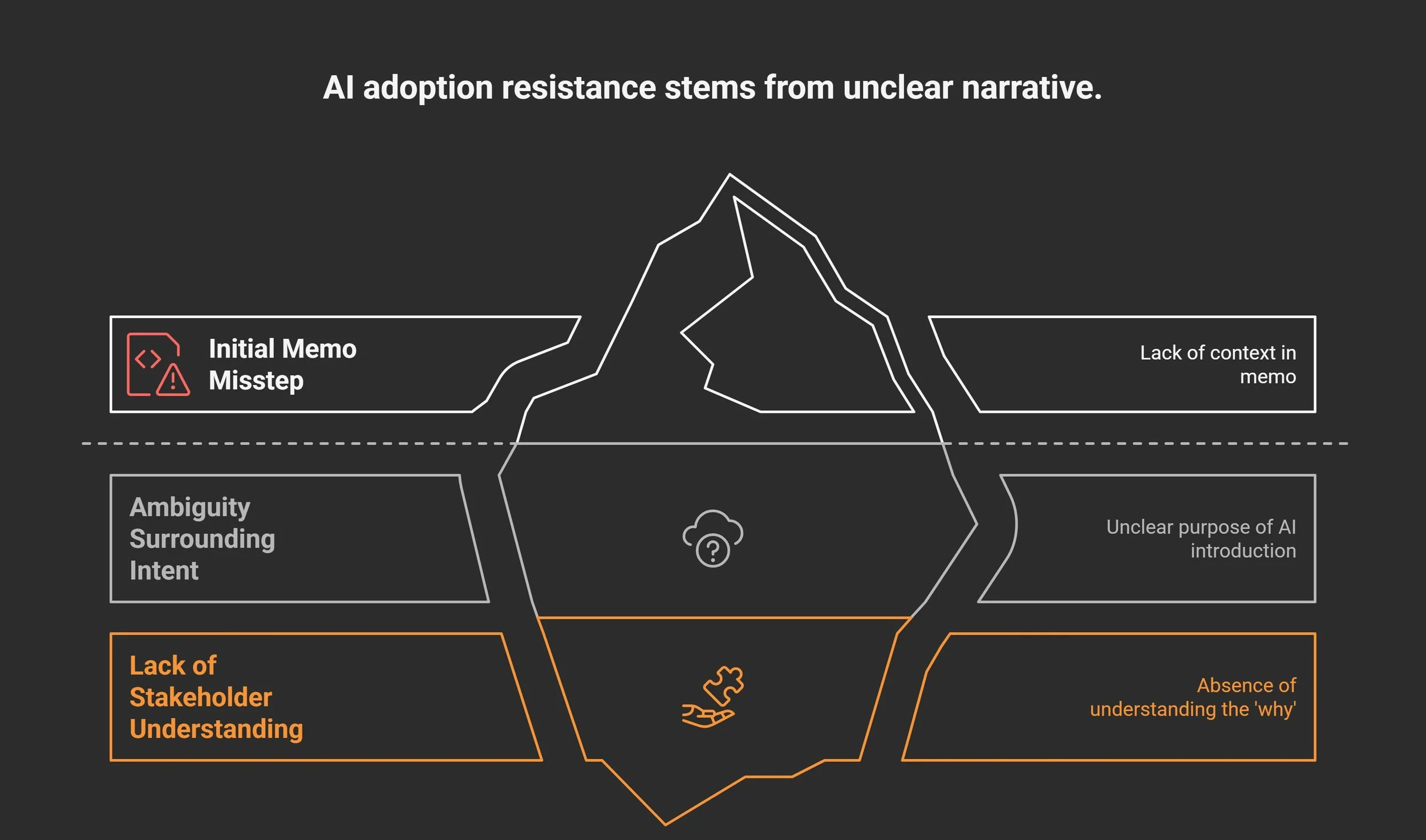

The Real Barrier: Communication

Von Ahn admitted he “did not give enough context” in his initial memo. That misstep is instructive. The resistance was not to AI itself but to the ambiguity surrounding its intent.

Trust leaders can draw from this: the obstacle is rarely the technology; it is the narrative. When AI adoption is introduced with clarity — framed as augmentation, not displacement — the cultural immune system weakens, and adoption accelerates.

This principle mirrors a broader truth outlined in our book AI Unleashed for Trustees & Family Offices: resistance fades when stakeholders understand the why behind AI, not just the what.

Strategic Fridays and Cultural Rituals

Duolingo instituted “f-r-A-I-days,” inviting employees to experiment with AI in open, playful ways. This ritual reduces anxiety and builds collective fluency. It transforms AI from a looming threat into a shared tool.

Trust companies can borrow this approach. Ritualized experimentation — weekly pilots, cross-team “AI labs,” small challenges — makes AI tangible and safe. It shifts the culture from fear to curiosity, from defense to exploration.

Financial Gravity

Despite public controversy, Duolingo’s fundamentals remain strong: 10.3 million paying users, 38% revenue growth, efficiency gains, and a suite of AI-powered features like conversational avatars.

The implication is clear. Properly positioned, AI is not a cost-cutting measure. It is a growth engine. For trustees and family offices, this translates into more clients served per officer, deeper personalization at scale, and operational resilience under mounting regulatory demands.

The Fiduciary Parallel

What trustees can learn from Duolingo:

AI does not erode trust — unclear communication does.

AI does not replace fiduciary responsibility — it amplifies it.

AI adoption is not about layoffs — it is about liberating talent.

The strategic path forward is to treat AI as structural scaffolding, not competitive labor. It is the invisible system that allows human expertise to scale, deepen, and endure.

The “AI-first” declaration shook Duolingo’s ecosystem only because the context was missing. Once clarified, the signal was unmistakable: AI is not a threat but a foundation.

Trust companies and family offices stand in the same moment of choice. Misframe AI, and fear will dominate. Frame it as evolution, and the workforce will lean in.

The future belongs not to those who automate the fastest, but to those who communicate the clearest.

FiduciaCorp: “Mastering AI, Empowering Wealth”