Stillness as strategy

Article Published in STEP Journal: Issue 6, 2025

Trustees are increasingly overwhelmed by operational complexity, compliance layering and decision fatigue, eroding strategic clarity and client trust.

Without structural redesign, firms risk governance drift, staff burnout and client attrition. A reactive posture becomes the norm.

This article provides a practical perspective on how AI, when carefully applied, can quietly reinforce fiduciary authority – not through speed or automation but through designed clarity and operational stillness.

The Swiss Tax Vote: Tax Rates Won the Vote. Operations Won the Market.

Switzerland rejected a wealth tax by 78%—and trust companies celebrated. Meanwhile, Dubai added 200+ new family-related structures, Singapore doubled to 2,000+ MAS-registered Section 13 family offices, and Permira paid 26x EBITDA for technology-ready JTC. The real referendum happens daily: UHNW clients choose jurisdictions based on operational capability, not tax rates.

The JTC Sovereignty Blueprint: Why Trust Companies Fail at Scale—and How Three Strategic Systems Solve It

JTC commanded a £2.7 billion exit and 26.2x EBITDA multiple by proving one rare capability: operational excellence that survives complexity at scale. Most trust companies plateau because their infrastructure can't support strategic acquisitions, multi-jurisdiction expansion, or AI integration without introducing dependency risks. The firms that attract premium partners share a common architecture—sovereign systems that create leverage, not just capacity. Read how three core systems unlock this positioning.

When Regulators Ask "Show Us the Trail" — And You Can't

Most firms treat AI as productivity software. Regulators treat it as infrastructure.

By 2026, winners won’t move fastest—they’ll prove best.

FiduciaCorp builds sovereign architecture where every AI decision has a trail and a signature.

Calm. Certain. Admissible.

The 2027 Compliance Reset: Turning CRS 2.0, CARF & the EU AI Act into Competitive Architecture

CRS 2.0/CARF and the EU AI Act don't add noise—they define the new operating architecture. We show how secure data, fiduciary-specific intelligence, and EU-AI-Act governance turn reporting into advantage and Boards at ease. Watch:The 2027 Compliance Reset — Session 3.

Why AI Fails Most Trust Companies: The Hidden Gap Between Generic Platforms and True Fiduciary Intelligence

Most trust companies implement AI that accelerates administration without understanding fiduciary obligation. Systems process faster while teams work harder—verifying outputs, reconciling exceptions, preserving the discretion automation cannot recognize.

FiduciaCorp architects intelligence within fiduciary logic, where systems interpret rather than execute, preserve rather than expose, strengthen rather than bypass the judgment that defines your mandate.

Read more →

Beneficial Ownership Registers 2025: Switzerland, Bermuda, Malta — Operational Shifts Every Trustee & Family Office CEO Must Implement

Switzerland, Bermuda and Malta have re-engineered beneficial-ownership disclosure.

Verification is now authority-led, privacy-respecting, and evidence-driven.

Discover what converges — and how to architect BO truth without friction.

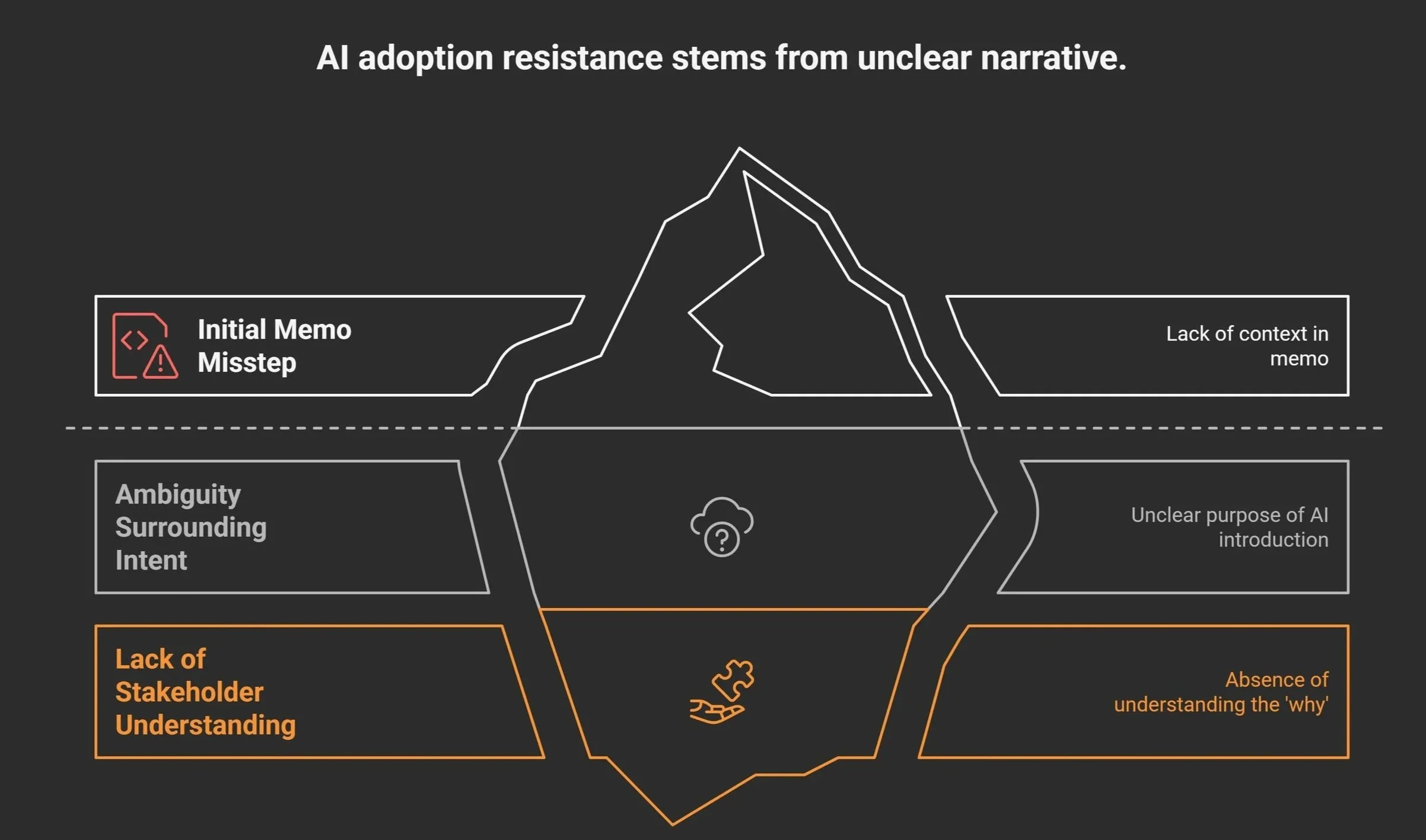

AI Implementation Is a Human Project: Why Technology Alone Never Delivers Transformation

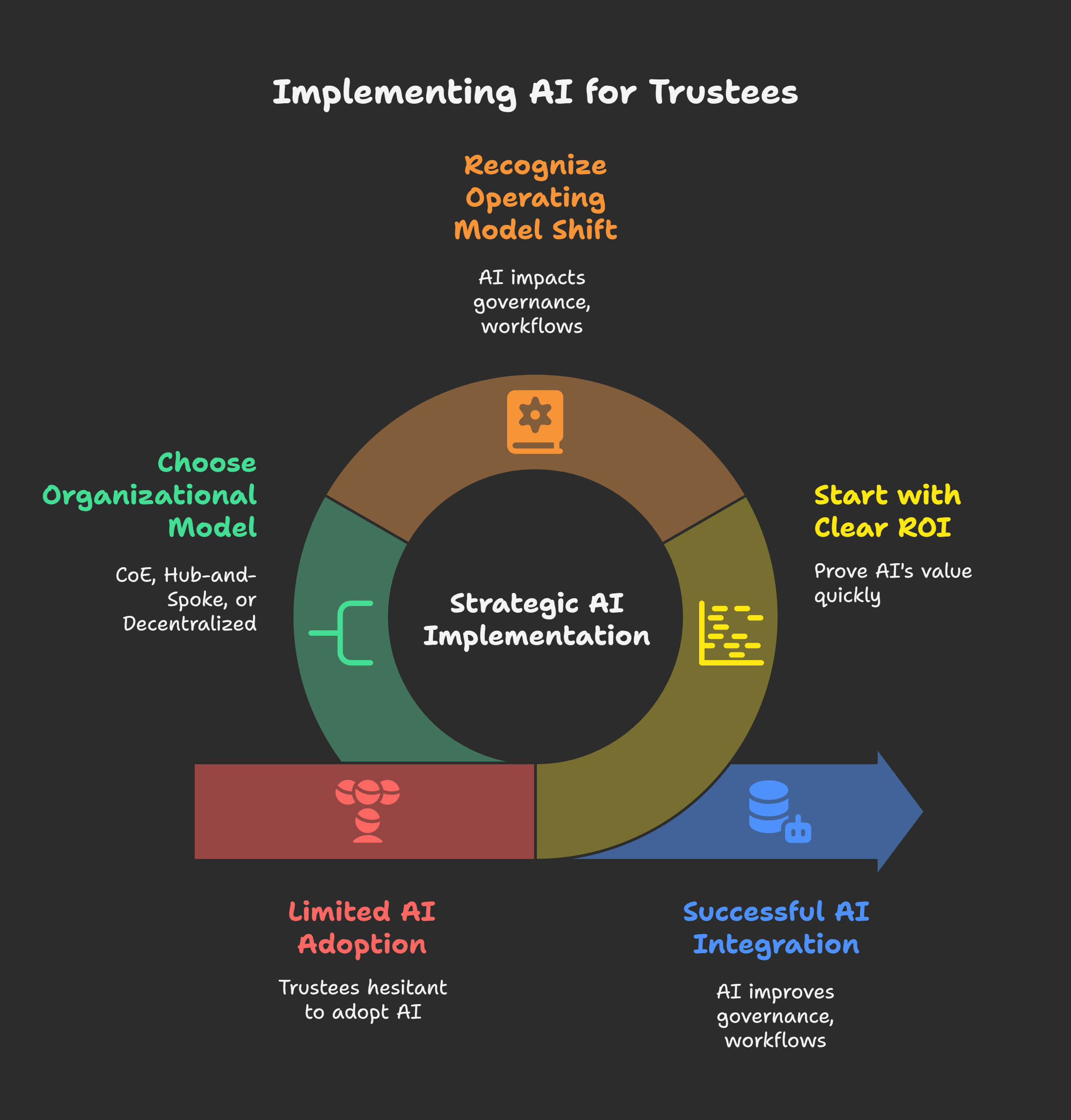

AI implementations fail not from inadequate technology but from treating human transformation as a technical problem.

When a Swiss fiduciary group unified eight functions across four jurisdictions, success came from human alignment that technology amplified—never from tools attempting to replace it.

RAND cites >80% AI-project failure; MIT finds ~95% of GenAI pilots lack measurable P&L impact—driven by organizational, not technical, gaps.

Architecture that addresses people first, systems second, delivers transformation.

The Silent Crisis: When Trust Companies Can't Deliver What Clients Demand

Why Legacy Trust Structures Are Failing GCC Families — And What to Build Instead

Legacy trust models can’t withstand UAE’s regulatory reforms, generational shifts, and digital assets.

Discover how adaptive wealth ecosystems protect governance, preserve continuity, and align with DIFC/ADGM evolution.

FiduciaCorp architects sovereign trust ecosystems—quiet, modular, resilient.

The Compliance Singularity: Switzerland's Transition to Verification-First Oversight

Swiss fiduciary compliance has entered a verification-first era.

Legacy systems built to document effort now expose you to regulatory risk.

FiduciaCorp replaces fragility with real-time, audit-ready infrastructure — seamlessly.

No dashboards. No scrambling. Just structural certainty.

Discover what operational sovereignty actually looks like.

The Silent Revolution in Wealth Stewardship: AI as a Fiduciary Force Multiplier

AI will not replace fiduciaries — but it will redefine them. Discover how embedded automation is reshaping trust company operations, advisor-client dynamics, and regulatory accountability.

When Experience Becomes the Risk: Key Insights from Frédéric Sanz Presentation at the PCD Dinner, Geneva - Hotel Mandarin Oriental 9 September 2025

At the PCD Group dinner, Frédéric Sanz spoke with leaders who built the trust industry.

The future of fiduciary services won’t be build by tools — but by systems.

Adaptation is the new trust.

The risk isn’t change. The risk is hesitation.

Build now. Or watch others lead.

The 2027 Compliance Reset

In 2027, compliance becomes machine-readable. Boards that treat AI as architecture — not accessory — will remain in control. This briefing distills the structural shift fiduciaries cannot ignore.

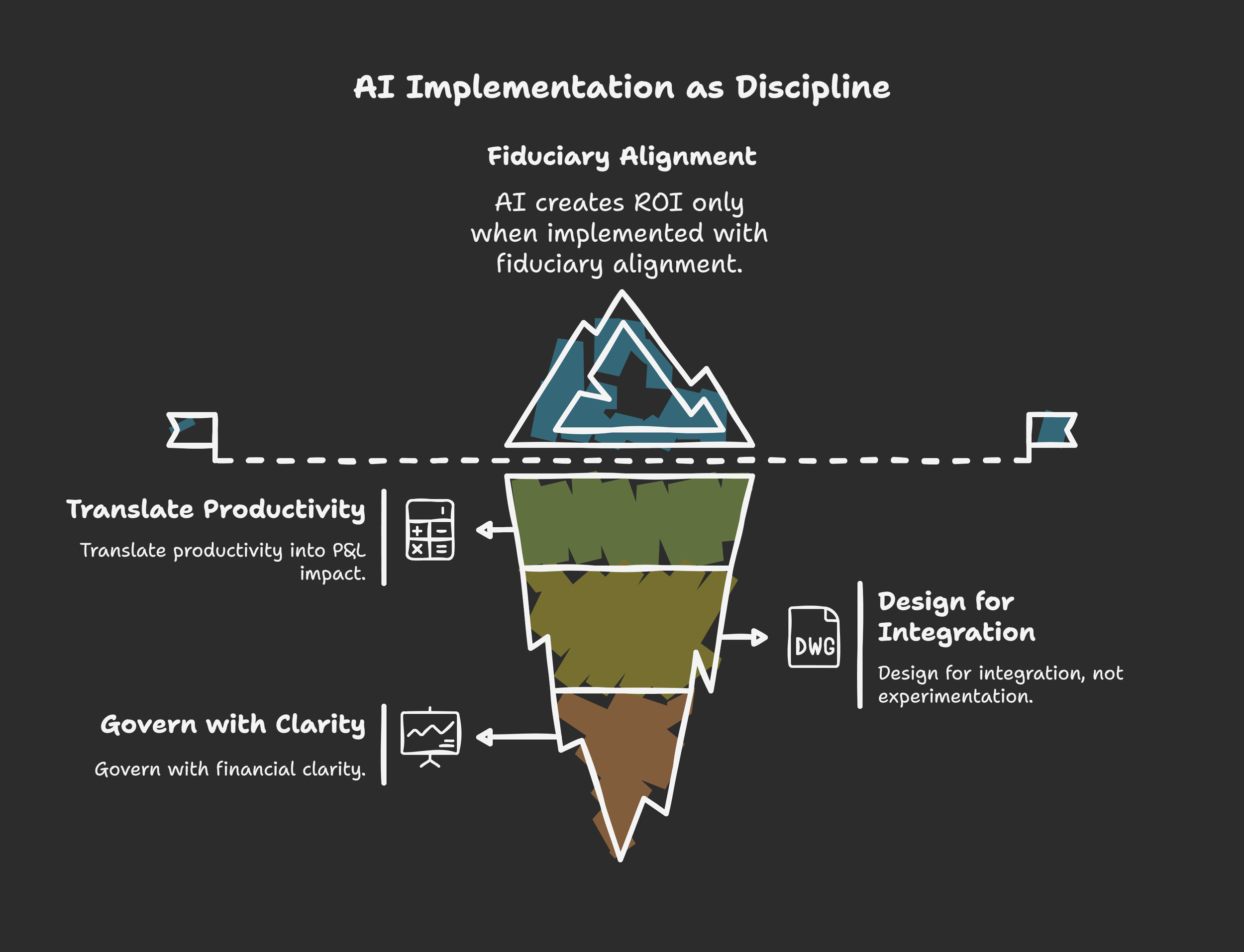

AI, ROI, and the Discipline of Fiduciary Implementation

AI is not optional but AI is not ROI until it reaches the P&L.

The question is whether it arrives as noise—or as fiduciary clarity.

FiduciaCorp exists to support trustees and family offices in sovereign execution. Not with hype. Not with tools for their own sake. But with measured, disciplined implementation that shows up where it matters—on the P&L.

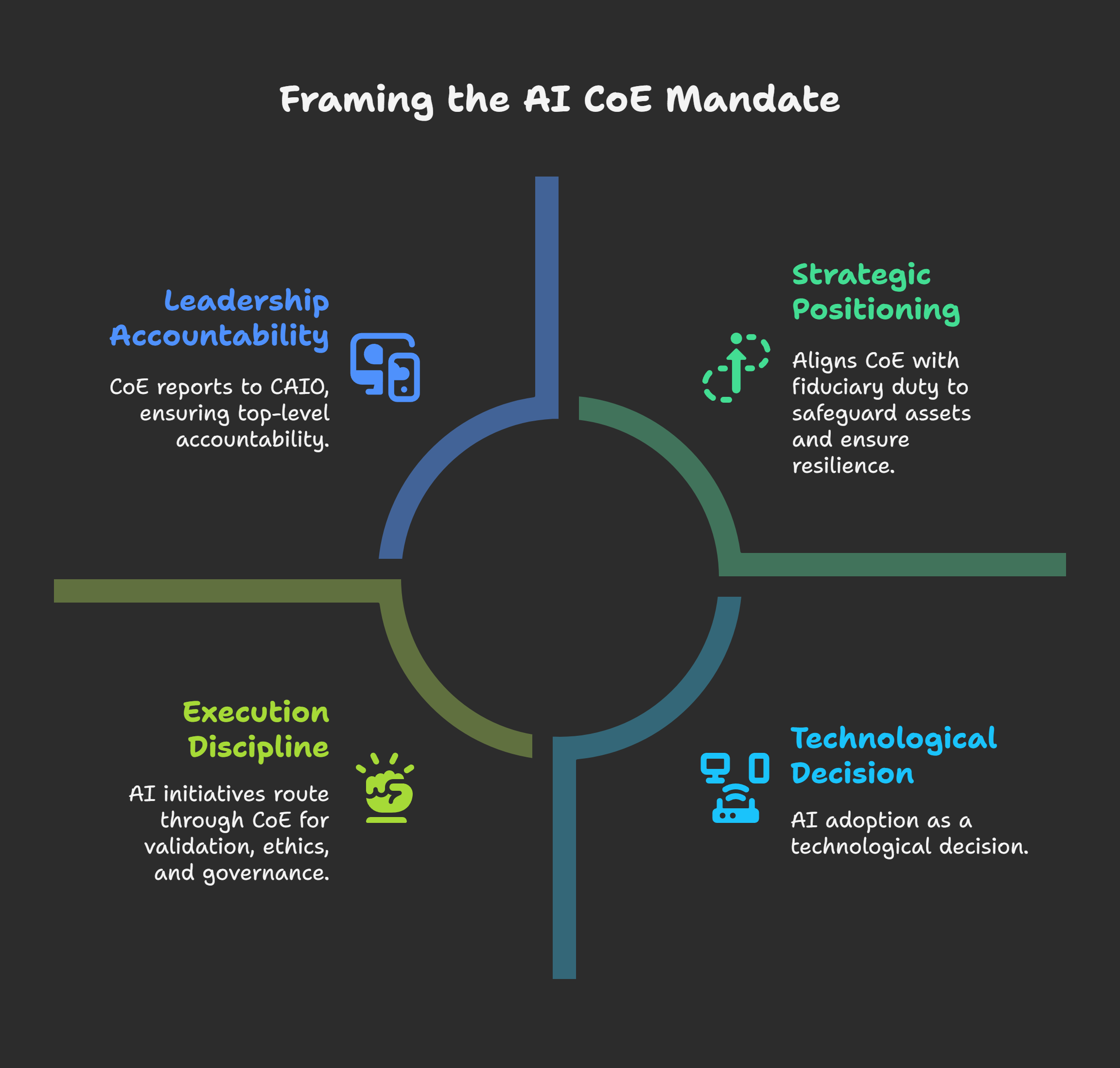

The Strategic Center of Excellence: How Banks Secure AI Sovereignty

The Center of Excellence is not a lab. It is the calm core of AI in banking. With CRS 2.0 and CARF looming, a CoE can deliver enterprise governance, scalable compliance, and client trust. Without it, AI remains fragmented experiments. With it, AI becomes fiduciary sovereignty.

The AI Profits Drought: What Trustees and Family Offices Must Learn from History

AI’s profit drought mirrors the lessons of history. Despite billions invested, most firms see little return—yet targeted applications already deliver real value. Trustees and family offices who endure the J-curve of adoption will emerge with lasting structural advantage.

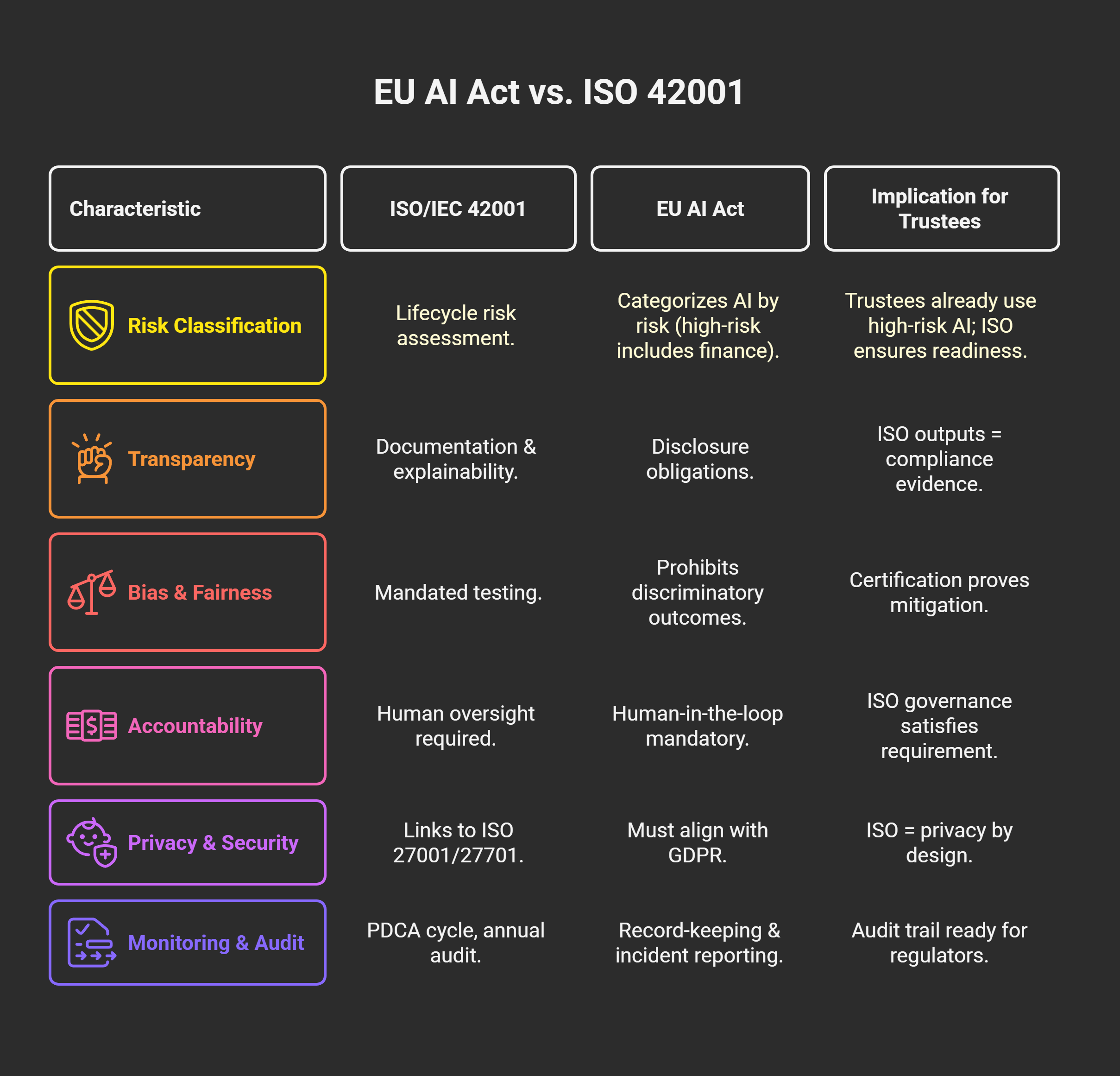

ISO 42001 and the EU AI Act: A Dual Architecture

AI now drives trust operations. ISO/IEC 42001 provides the first global framework to govern it — and directly aligns with the EU AI Act. For trustees and family offices, certification is not compliance. It is sovereignty, and it is regulatory advantage.

AI-First Without Fear: What Duolingo Reveals About Workforce Evolution

AI adoption fails when it is framed as replacement. Duolingo’s “AI-first” pivot shows that the real challenge is not technology but communication. Trustees can learn: AI does not erase responsibility — it elevates it.

Where the Fiduciary Industry Is Heading: From Service Vendor to Sovereign Operating Partner

Fiduciary work is moving from documents to governed activity.

Platforms like KRAIOS normalize workflows, regulatory intelligence, and SLAs across jurisdictions.

Operational sovereignty is now a design choice, not a headcount problem. Here’s how to build it—quietly, decisively.

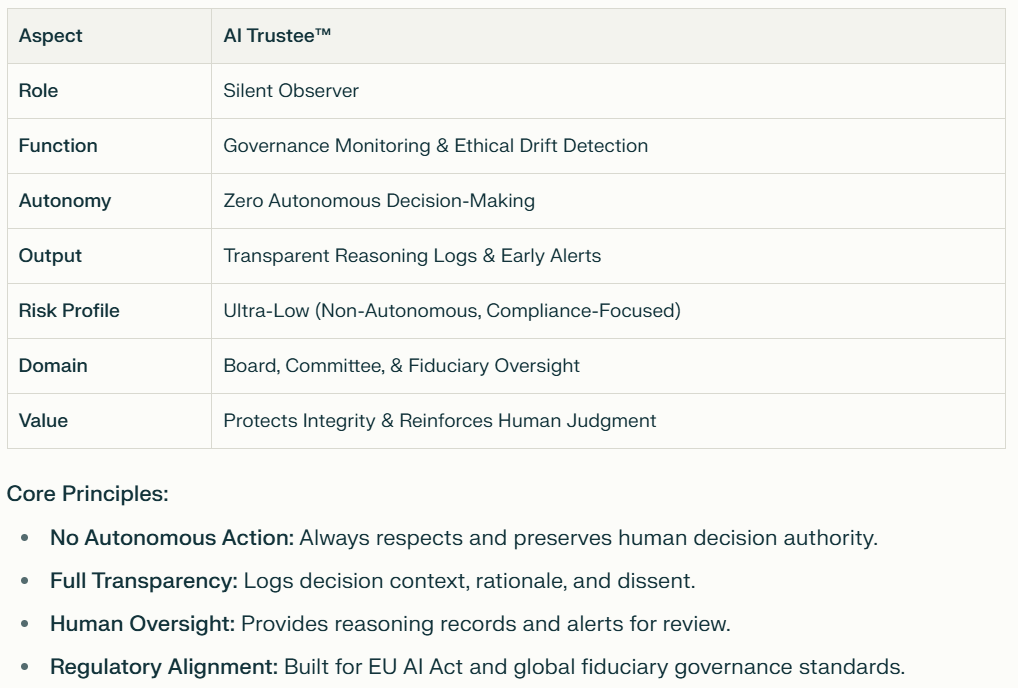

The AI Trustee™ – The Silent Architecture for Daily Fiduciary Clarity

The AI Trustee™ is a silent safeguard for the daily work of trust officers — from verifying KYC to recording decisions.

It doesn’t replace judgment.

It preserves it — with immutable reasoning logs, real-time anomaly detection, and regulatory alignment. Now in pilot phase for select fiduciary leaders.