The 2027 Compliance Reset

“The pace of AI progress is unlike anything we’ve seen in technology.” — OpenAI Leadership Guide, 2025

By January 2027, CRS 2.0 and CARF will not request documents. They will interrogate systems.

The only question left for fiduciary boards is simple: are you ready?

Succesful companies already see AI adoption driving revenue growth 1.5x faster than peers. Yet most fiduciary boards remain frozen — unsure how to govern in an era of machine-speed regulation. The problem isn’t technical. It’s structural.

By 2027, fiduciary oversight will no longer be judged by manual effort, but by the architecture of your systems. Compliance will not mean “catching up.” It will mean remaining in control.

For trustees, directors, and family offices, the threshold is clear: unless you can demonstrate automated, auditable, regulator-ready systems, you will not be considered compliant.

This is the compliance reset. And it is not optional.

The Machine Is the Auditor

From January 2027, CRS 2.0 and CARF will not “request documents.”

They will interrogate systems.

Reporting frameworks must speak the machine’s language — or be deemed non-cooperative.

This is no longer about hiring compliance officers. It is about re-engineering governance.

TMF Group, for instance, has disclosed over €50M in compliance technology spend. Not excess — survival. Proof must now be system-native.

From Tool to Architecture

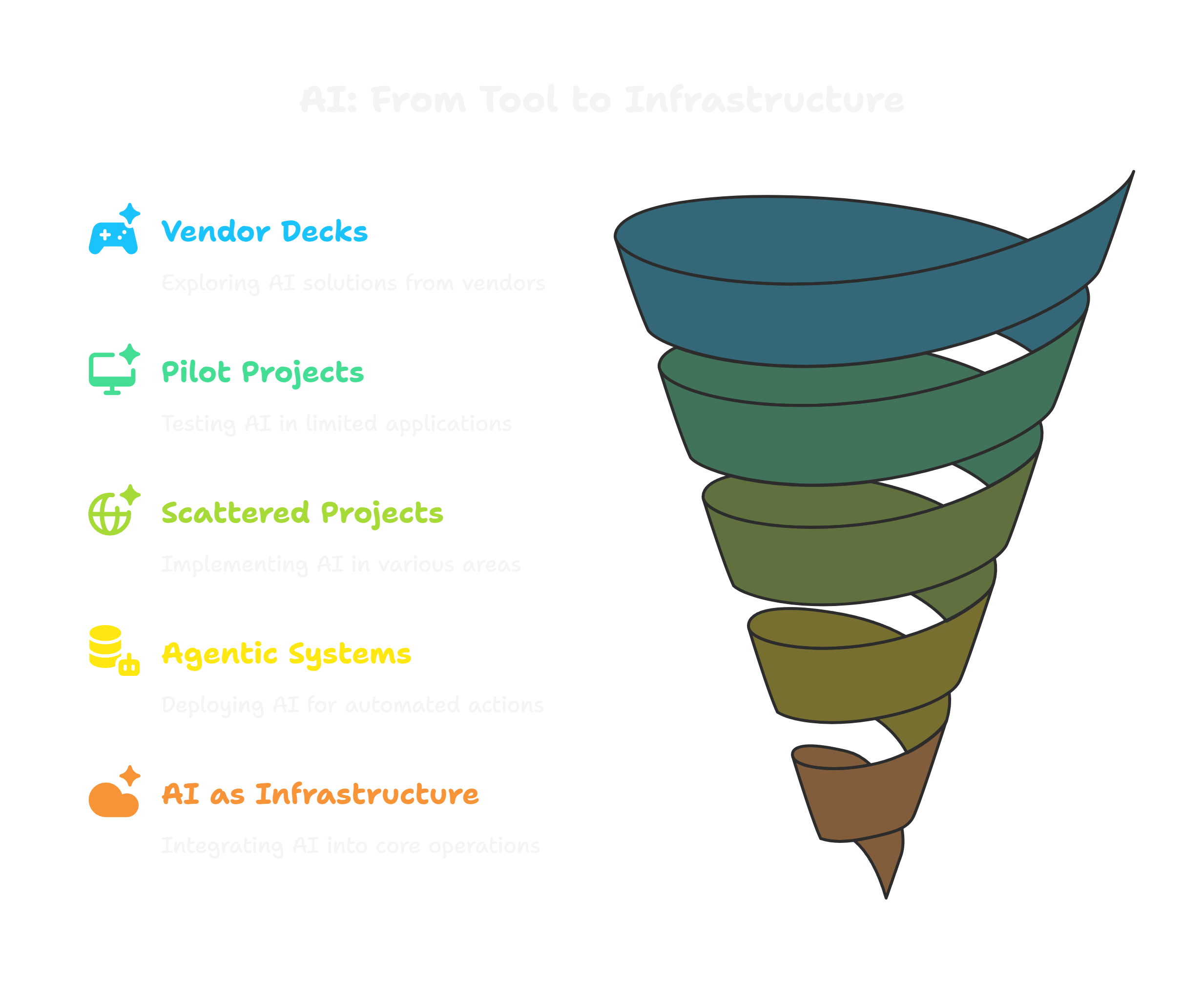

Most boards are stuck in the “tool phase” — vendor decks, pilots, scattered projects. But AI is no longer a tool. It is infrastructure.

Agentic systems — capable of initiating actions — are already deployed in KYC onboarding, liquidity forecasting, and fraud detection. Properly governed, they reduce fatigue and elevate oversight. Poorly managed, they create opacity and risk drift.

The leadership imperative: install AI as architecture, not accessory.

Strategic Applications, Not Hype

Ignore avatars and generative “fluff.” The defensible domains for fiduciary AI are clear:

Automated KYC/AML — reduce false positives, accelerate reviews.

Document Intelligence — extract obligations, risk triggers, and conflicts from complex agreements.

Predictive Liquidity Models — anticipate capital events, lower friction, protect credibility.

ROI lies in friction removed, not in flashy dashboards.

The Client Power Shift

Heirs are digital natives. Most are women.

They will not tolerate opacity. They expect transparency, immediacy, and values alignment.

If your systems cannot generate real-time insights on demand, your relevance is already fading.

AI allows fiduciaries to segment, detect sentiment, and personalize at scale.

This is not “value-add.” This is the minimum condition for maintaining trust.

The Architecture Decision

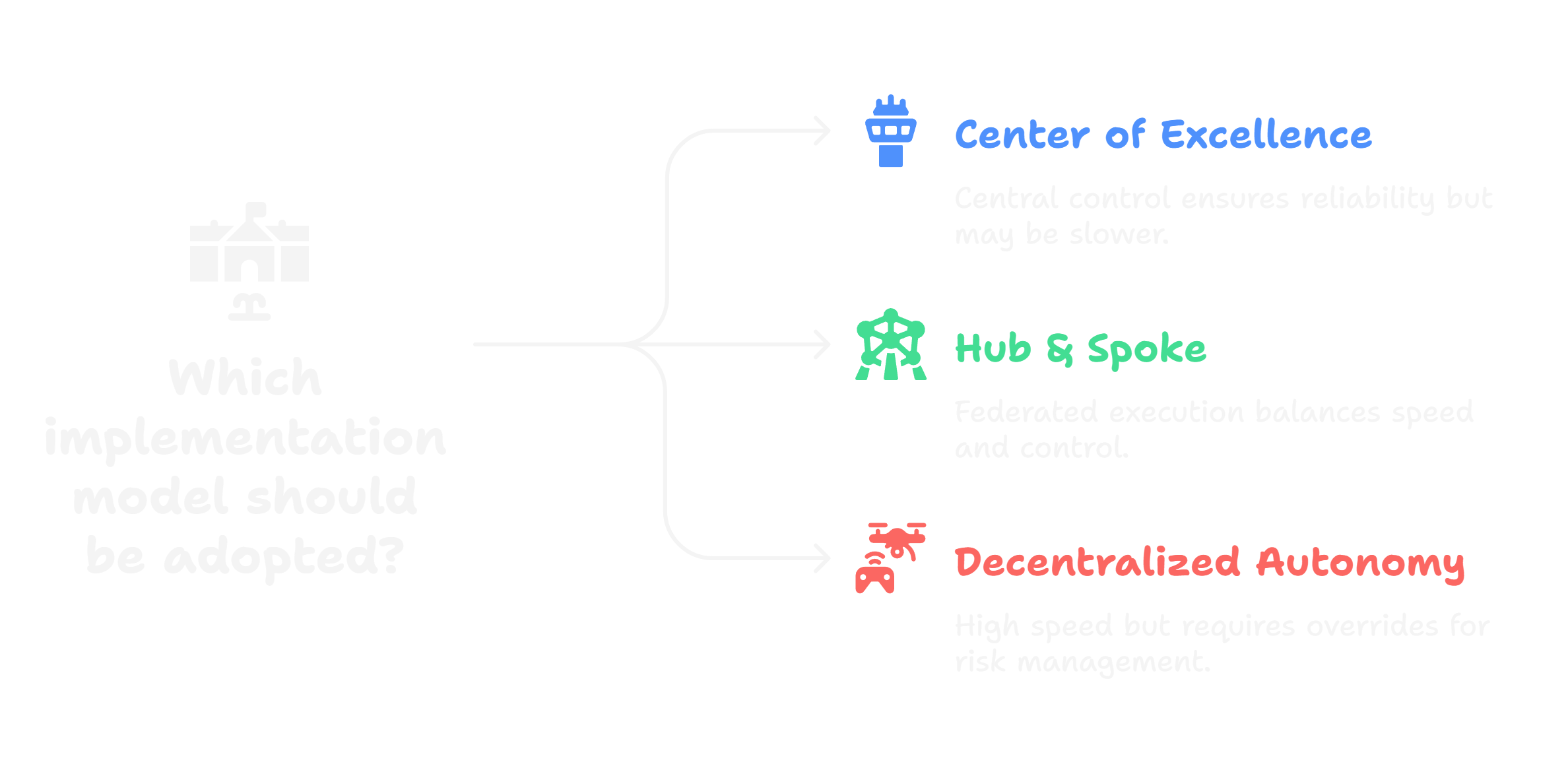

The most dangerous failure we see in boardrooms is indecision.

By 2027, there are only three viable governance models:

Center of Excellence — central control, slower but reliable.

Hub & Spoke — federated execution with guardrails.

Decentralized Autonomy — high speed, but risky without overrides.

Your decision is your governance. Waiting is abdication.

This Is the Reset

AI is not “coming.” It is here.

Boards that fail to move from tool adoption to architectural clarity will not be overtaken by competitors.

They will be sidelined — by regulators, by heirs, by irrelevance.

The 2027 Compliance Reset is not for everyone.

It is built for boards who intend to govern across borders, under scrutiny, without margin for noise.

Seven briefings. Under 20 minutes each. For leaders who understand that sovereignty in the AI era is not optional — it is the standard.

→ Access the full Board Briefing Series

FiduciaCorp: Mastering AI, Empowering Wealth