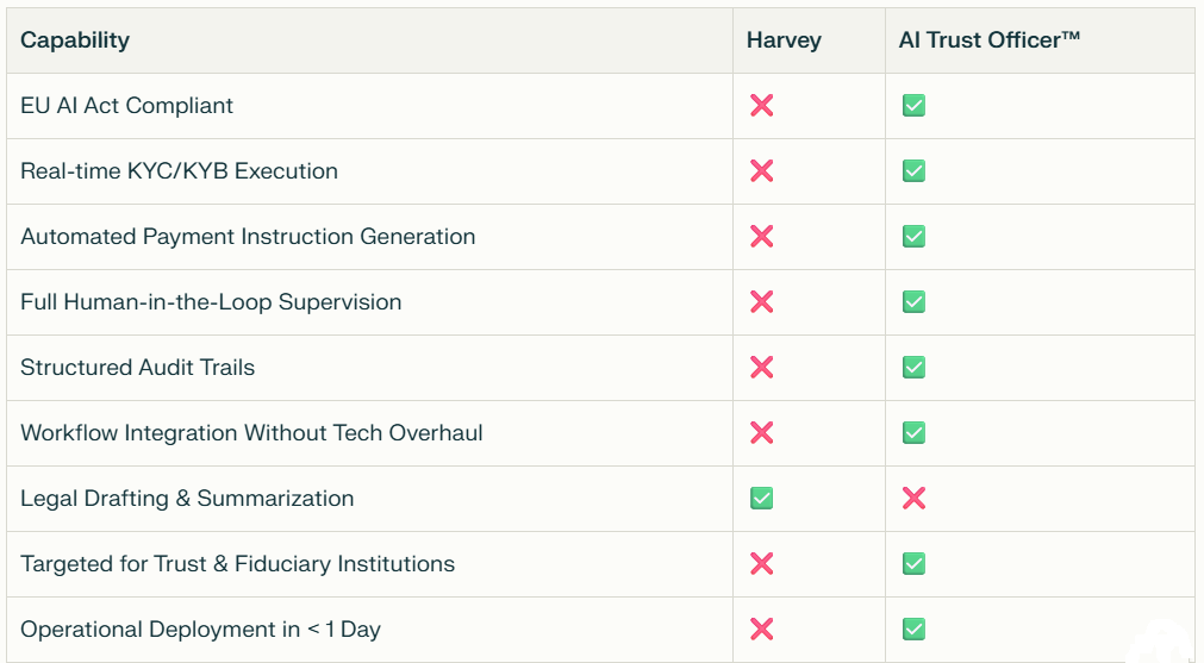

HARVEY VS. THE AI TRUST OFFICER

The Trust industry defined by judgment, discretion, and regulatory exposure, clarity is not a luxury — it is a fiduciary obligation. Harvey and other general-purpose legal AI tools promise efficiency. They deliver it. But when applied to fiduciary infrastructure, they reveal their limit: these tools accelerate work, not trust. And trust is not built through speed. It’s built through structure.

Harvey is fast. The AI Trust Officer is sovereign.

The Friction Hidden in Legal AI

Legal departments have long sought efficiency in document review, clause extraction, and summarization. Harvey’s model excels here. But this domain expertise is narrow — it does not cover the full spectrum of operational execution fiduciaries require.

Trust companies and family offices are not legal drafting factories. They are execution environments with zero tolerance for ambiguity, audit gaps, or invisible friction.

The core risks fiduciaries face are not missed clauses. They are:

Missed approvals

Untraceable payments

Manual compliance cycles

Silent process drift

Harvey can read documents. But it cannot govern workflows. It cannot structure execution logic. And it cannot offer real-time clarity on where friction, delay, or exposure is building up in your system.

Table 1: Harvey vs AI Trust Officer

The Mandate of the AI Trust Officer

The AI Trust Officer was built for a different question:

How do we protect judgment in high-risk, high-complexity execution environments?

Its answer is structural. Instead of generating text, it generates clarity. It integrates into existing systems — Outlook, Excel, payment tools — and governs execution directly:

Real-time KYC automation with full audit trails

Automatic generation of payment instructions with signature logic

Live inbox monitoring and AI-based reply handling

Embedded human-in-the-loop control, always

It is not a co-pilot. It is not a chatbot. It is not a legal assistant.

It is a fiduciary execution system. The first of its kind.

Sovereignty Begins Where Legal AI Ends

Harvey accelerates legal teams. But it does not protect fiduciary execution.

Speed does not equal sovereignty.

Sovereignty means structure:

That doesn’t rely on memory.

That doesn’t drift under stress.

That doesn’t depend on any one team member to function.

Fiduciaries don’t need more assistance. They need invisible precision.

That’s what the AI Trust Officer installs.

Speed is seductive. But sovereignty is subtle.

The AI Trust Officer runs silently on your infrastructure. It never leaves your server. It anonymizes data before parsing. It is fully compliant with the EU AI Act and can be verified at any moment — by you, by regulators, by clients.

Its modules install in two hours. Its logs are immutable. Its actions are reversible. Its presence is invisible — until needed.

This is not a promise. It is an operating state.

And it exists today.

Table 2: Lawyer Productivity vs.Fiduciary Protection

One Brings Speed. The Other Brings Control.

Harvey will continue to transform legal work. It has its place — and performs it well. But it was not designed to carry fiduciary load. It does not operate with the control, traceability, and judgment architecture that execution demands in UHNW wealth environments.

When trust companies delegate execution to general-purpose legal tools, they gain efficiency — and risk losing sovereignty. The AI Trust Officer exists to prevent that.

It doesn’t draft documents. It doesn’t automate judgment. It creates conditions where judgment can execute, cleanly.

FiduciaCorp : "Mastering AI, Empowering Wealth"